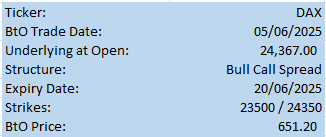

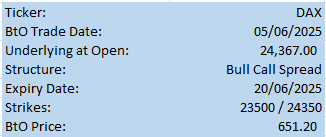

Bull Call Spread to capture Dax move upwards

I opened a position in DAX 30 this morning after a breakout to the upside following a period of consolidation.

I opened a position in DAX 30 this morning after a breakout to the upside following a period of consolidation.